Secure Your Comfort With Reliable Home Insurance Plan

Why Home Insurance Is Important

The significance of home insurance policy hinges on its capacity to provide financial security and peace of mind to property owners in the face of unpredicted occasions. Home insurance coverage offers as a safety and security net, providing protection for problems to the physical structure of the house, individual possessions, and responsibility for mishaps that might occur on the property. In the occasion of natural calamities such as fires, floodings, or quakes, having a detailed home insurance policy can help house owners recoup and rebuild without encountering substantial economic burdens.

Moreover, home insurance coverage is frequently required by mortgage lending institutions to secure their financial investment in the residential or commercial property. Lenders intend to make sure that their monetary rate of interests are guarded in case of any type of damages to the home. By having a home insurance coverage in position, house owners can meet this demand and protect their financial investment in the property.

Types of Coverage Available

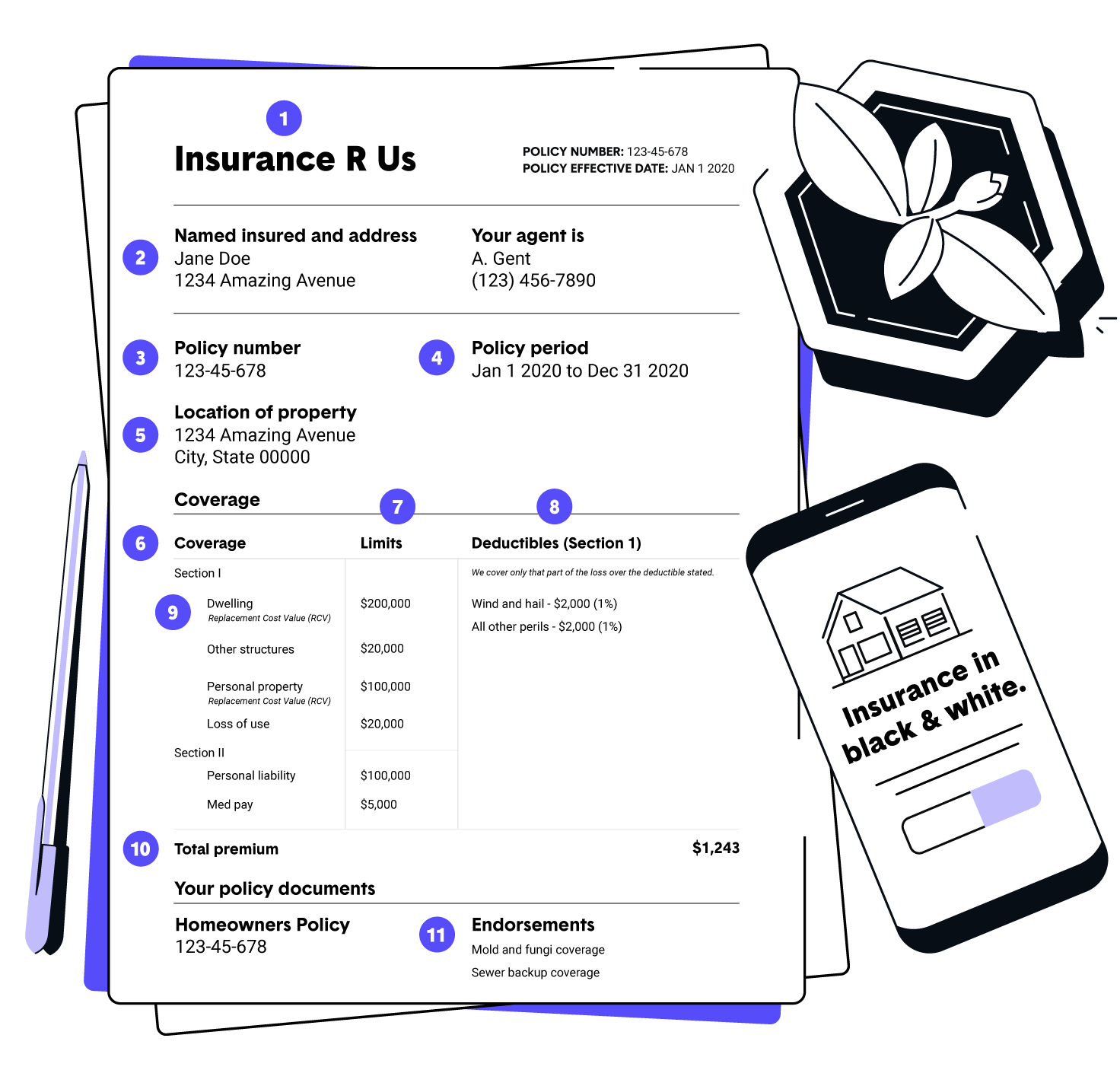

Given the value of home insurance coverage in shielding property owners from unexpected financial losses, it is essential to recognize the numerous kinds of coverage available to tailor a plan that fits private needs and situations. There are numerous crucial types of protection used by the majority of home insurance coverage plans. The first is dwelling protection, which safeguards the structure of the home itself from risks such as fire, criminal damage, and natural calamities (San Diego Home Insurance). Individual residential property insurance coverage, on the various other hand, safeguards items within the home, including furniture, electronics, and garments. Responsibility protection is crucial for safeguarding home owners from medical and legal costs if somebody is hurt on their residential property. Extra living costs protection can aid cover costs if the home comes to be unliveable due to a covered loss. It is necessary for homeowners to carefully evaluate and comprehend the various kinds of coverage offered to ensure they have adequate protection for their particular requirements.

Aspects That Effect Premiums

Factors influencing home insurance costs can vary based on a variety of factors to consider particular to private conditions. Older homes or residential properties with outdated electrical, plumbing, or heating systems may present greater dangers for insurance policy companies, leading to greater costs.

In addition, the coverage restrictions and deductibles chosen by the insurance policy holder can influence the premium amount. Selecting greater protection limitations or lower deductibles usually leads to higher costs. The type of building products used in the home, such as timber versus block, can likewise impact costs as particular materials may be a lot more vulnerable to damage.

Exactly How to Choose the Right Plan

Picking the ideal home insurance coverage entails careful consideration of different vital facets to make certain extensive insurance coverage customized to specific demands and situations. To begin, assess the worth of your home and its contents accurately. Comprehending the replacement expense of your house and valuables will aid identify the protection limitations called for in the policy. Next, consider the various sorts of insurance coverage offered, such as dwelling insurance coverage, individual building protection, liability protection, and added living expenditures protection. Dressmaker these insurance coverages this content to match your specific needs and threat aspects. Additionally, evaluate the plan's deductibles, limits, and exclusions to ensure they line up with your financial capabilities and take the chance of resistance.

In addition, evaluating the insurer's look at more info online reputation, economic security, consumer service, great site and declares process is critical. Seek insurance companies with a background of trustworthy service and timely insurance claims negotiation. Compare quotes from several insurers to discover a balance in between expense and coverage. By very carefully examining these aspects, you can pick a home insurance coverage policy that gives the necessary defense and assurance.

Advantages of Reliable Home Insurance Policy

Trusted home insurance policy supplies a complacency and security for property owners versus economic losses and unanticipated events. Among the crucial advantages of reliable home insurance is the assurance that your home will certainly be covered in case of damage or devastation brought on by natural calamities such as fires, storms, or floodings. This insurance coverage can help house owners stay clear of birthing the complete price of repair work or restoring, offering comfort and monetary stability during challenging times.

Furthermore, dependable home insurance plan commonly consist of liability protection, which can safeguard homeowners from clinical and legal expenditures when it comes to accidents on their property. This protection expands beyond the physical framework of the home to shield versus suits and insurance claims that may emerge from injuries endured by site visitors.

Additionally, having reliable home insurance can likewise add to a feeling of overall well-being, knowing that your most significant financial investment is protected against different threats. By paying normal premiums, homeowners can mitigate the prospective monetary problem of unforeseen occasions, allowing them to concentrate on appreciating their homes without continuous concern about what might take place.

Verdict

Finally, safeguarding a reputable home insurance policy is important for shielding your residential property and items from unanticipated events. By understanding the kinds of protection offered, variables that influence costs, and exactly how to select the right plan, you can ensure your peace of mind. Counting on a trustworthy home insurance policy supplier will certainly offer you the advantages of monetary protection and protection for your most useful asset.

Navigating the world of home insurance can be complex, with numerous coverage options, policy factors, and considerations to weigh. Understanding why home insurance coverage is vital, the types of protection available, and just how to select the appropriate policy can be crucial in ensuring your most substantial investment continues to be safe.Given the importance of home insurance coverage in safeguarding home owners from unanticipated monetary losses, it is essential to recognize the various kinds of protection available to tailor a policy that matches specific needs and scenarios. San Diego Home Insurance. There are numerous crucial kinds of coverage offered by the majority of home insurance coverage policies.Selecting the proper home insurance plan includes careful factor to consider of numerous crucial aspects to ensure comprehensive coverage customized to individual requirements and circumstances

Comments on “Some Known Questions About San Diego Home Insurance.”